Shark Tank India has become a hub for entrepreneurs seeking investments from seasoned business experts, also known as sharks. Beyond entertainment, the show offers a wealth of knowledge on business and finance. However, for viewers unfamiliar with the terms frequently used, the discussions can be challenging to follow. Here’s a simplified guide to some of the essential finance-related terms commonly heard on the show.

1. Equity

Equity refers to the ownership of a company. When entrepreneurs offer equity, they are essentially giving a percentage of their business to the investor in return for funding.

Example:

If a business owner offers 10% equity for ₹50 lakhs, the investor will own 10% of the business after investing that amount.

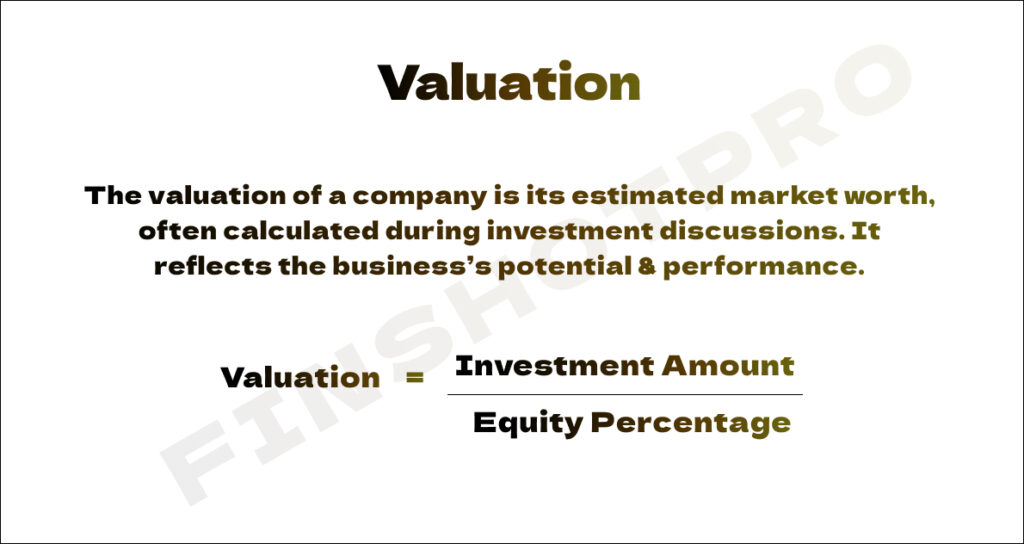

2. Valuation

The valuation of a company is its estimated market worth, often calculated during investment discussions. It reflects the business’s perceived potential and performance.

Formula:

Example:

If an entrepreneur seeks ₹50 lakhs for 10% equity, the company’s valuation is ₹5 crores.

3. Revenue

Revenue is the total income generated by a business through its sales or services before deducting any costs or expenses. It reflects the scale of operations.

Revenue Models:

B2C (Business to Consumer): Directly selling to end-users.

B2B (Business to Business): Supplying products or services to other businesses.

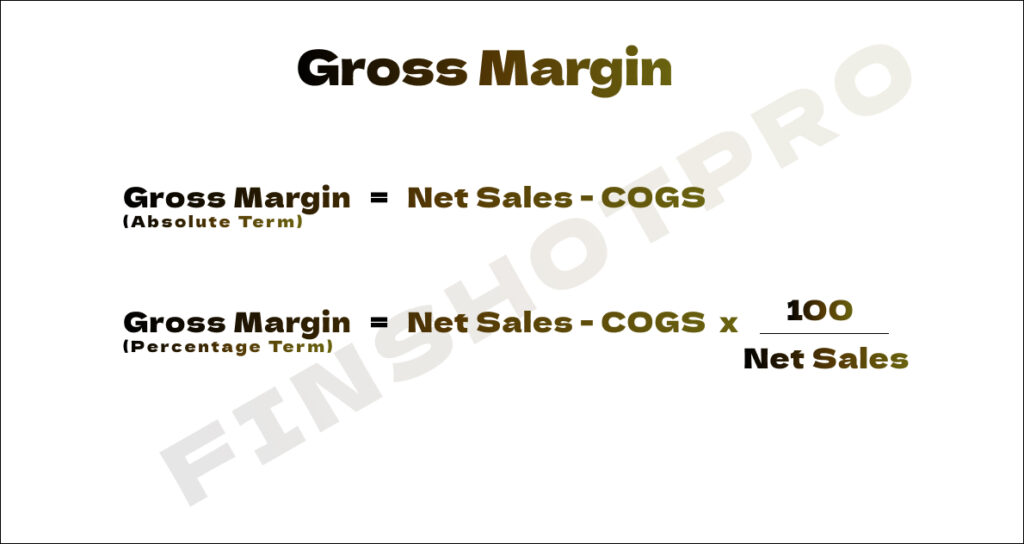

4. Gross Margin

Gross margin represents the percentage of revenue left after accounting for the cost of producing goods or services (COGS). It indicates how efficiently a business controls production costs.

Formula:

5. Burn Rate

Burn rate is the rate at which a startup spends its available cash. It’s a critical metric for startups still working towards profitability.

Example:

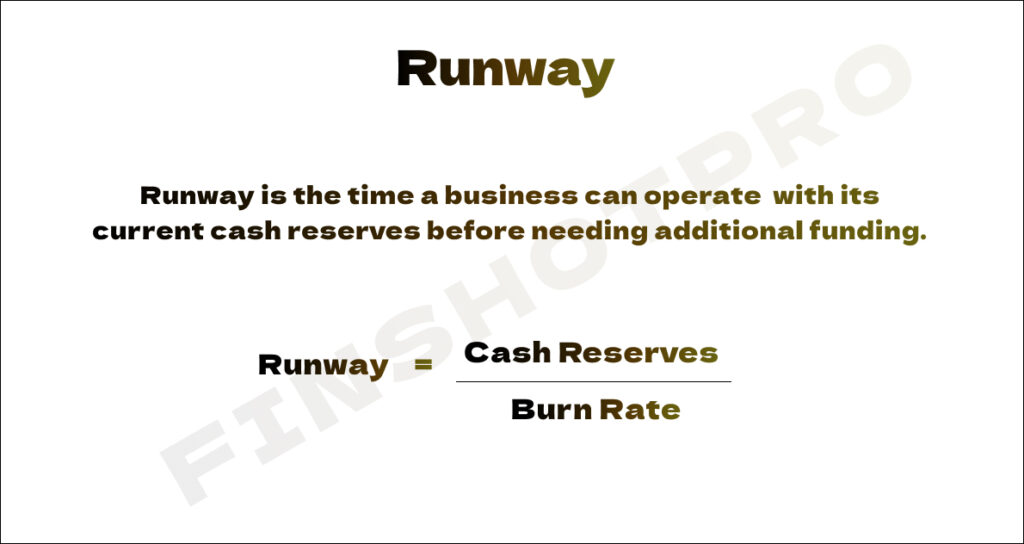

If a company spends ₹15 lakhs monthly and has ₹90 lakhs in reserves, it has a runway of 6 months.

6. Runway

Runway is the time a business can operate with its current cash reserves before needing additional funding.

Formula:

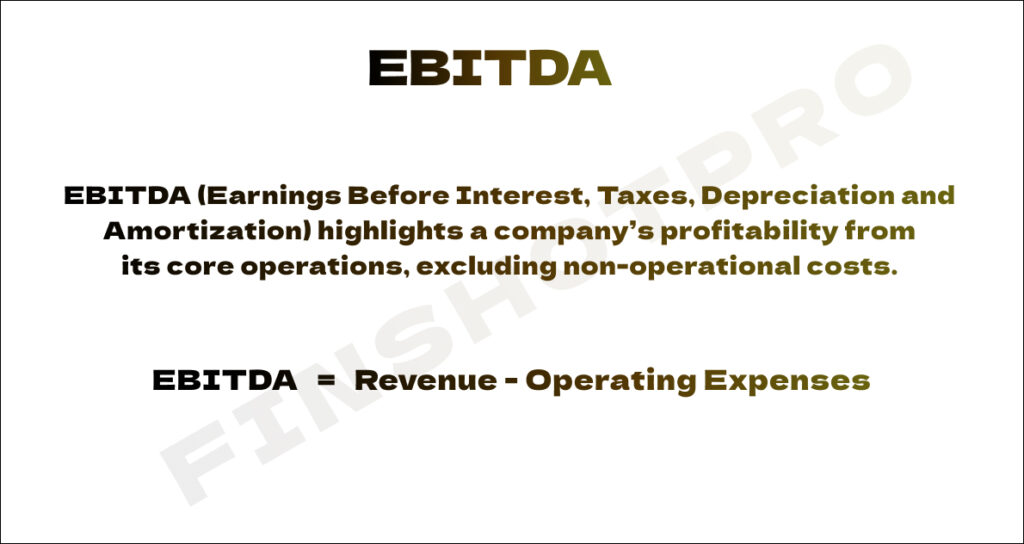

7. EBITDA

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) highlights a company’s profitability from its core operations, excluding non-operational costs.

Formula:

8. Pre-Money Valuation vs. Post-Money Valuation

Pre-Money Valuation: The estimated worth of a business before receiving external funding.

Post-Money Valuation: The business’s valuation after the investment is included.

Formula:

9. Profitability vs. Scalability

Profitability: The ability of a business to generate earnings exceeding its expenses.

Scalability: The potential of a business to grow without proportionally increasing its costs.

10. Debt vs. Equity Funding

Debt Funding: Borrowing money to be repaid with interest, often without giving up ownership.

Equity Funding: Raising money by offering shares of the business to investors.

Learn more about the Shark Tank key finance terms and how it can grow your basic finance curiosity over time by visiting this detailed article on Medium.

Final Thoughts on Shark Tank Key Terms

Shark Tank India introduces viewers to the complex world of entrepreneurship and finance. By understanding these terms, you’ll be better equipped to follow the discussions and appreciate the strategic decisions made by both entrepreneurs and investors.

For more such content, do visit Finshotpro